As many ARMs have rates that change every six months or once per year after the fixed-rate period ends, you could end up with unpredictable payments for a portion of your loan term.Ī good way to avoid this scenario is to refinance your adjustable-rate mortgage into a more stable and predictable fixed-rate mortgage.Ī homeowner might also refinance not to change the loan term, but rather to be able to escape paying for mortgage insurance.

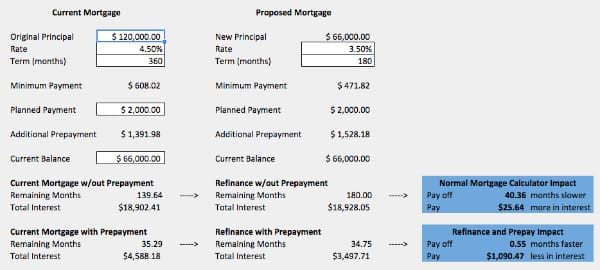

Should rates rise, you could face rising or even unaffordable monthly payments. At that time, your rate may go down or it may go up, and may be allowed to rise substantially. However, if your fixed-rate phase ends and you still own the home, you'll enter an adjustable-rate period in which your rate fluctuates based on an index. For example, you could switch from an adjustable to a fixed-rate mortgage.Īdjustable-rate mortgages offer low introductory rates during their initial fixed rate phase, making them attractive if you want to hold your home for a short period, say three to seven years. Refinancing allows you to convert from one loan type to another. Likewise, if you have significantly reduced your debt-to-income ratio or increased your credit score, you might be eligible for a lower rate. Lowering your mortgage rate by as little as a half of a percentage point will reduce your monthly payment. Of course, mortgage rates directly affect the amount of your monthly mortgage payment. If today’s rates are lower than the rate on your existing mortgage, a refinance could reduce your interest cost over the life of the loan. Mortgage rates change frequently based on prevailing economic conditions. Here are a few good reasons to consider a refi: To lower your mortgage interest rate Of course, refinancing a mortgage isn't suitable for everyone make sure you understand all the associated risks and costs to be sure it’s the right choice for you. But they are all usually aimed at one goal - saving money. You may look to refinance your original mortgage for a variety of reasons. Common Reasons to Refinance your Mortgage The refinance application process may also call for a home appraisal and inspection. In other words, a lender will again scrutinize your credit history, debt-to-income ratio, employment history, income, and home equity stake to determine if you qualify for a new loan. Refinancing requires completing a new mortgage application, although some lenders and certain loan products may offer a "streamline" process that eliminates some paperwork and costs. Mortgage refinancing is the process of replacing your current mortgage with a new loan to either lock in a lower interest rate, adjust your loan term, or even take cash out of your home. To get the most out of this calculator, be sure to read any commentary that appears with the results. Results appear below the calculator inputs.

Just fill in the boxes with the basic information from your existing loan and that from your expected new loan, then click "calculate".

#Simple refinance mortgage calculator how to

How to use this "Should I refinance my mortgage?" calculator Once you've decided to refinance, you can also learn the best way to pay for your refinance using our Tri-Refi calculator. This calculator will show how your mortgage payment will change if you refinance, when you can expect to recover your closing costs and when interest savings really begin to start, if ever. Shop and compare today's best mortgage refinance rates Believe it or not, it can even be possible to save money for a time with a refinance even if your new interest rate is higher than your existing one! It's all about the intersection of interest rates, costs and your expected time frame.

Just as it's possible to save money with a refinance, it's also possible that your refinance will cost you money. But it's important to know the real costs - and potential savings - before making a move. Whenever interest rates drop, the appeal of refinancing your mortgage grows.

0 kommentar(er)

0 kommentar(er)